Carbon Pricing 202: Pricing Carbon in the Transportation Sector

What are the effects of a carbon price on the transportation sector, from fuel prices to total miles traveled?

Carbon pricing aims to reduce the amount of carbon dioxide released into the atmosphere by either imposing a fee or a cap on carbon dioxide emissions. When covering the transportation sector, carbon pricing usually applies to the combustion of transportation fuels; it raises fuel prices, discouraging vehicle travel and encouraging the use of cleaner vehicles (such as electric vehicles) and alternative modes of travel (such as public transit). This explainer details how carbon pricing can reduce emissions from the transportation sector by affecting fuel prices, miles traveled, vehicle ownership, and travel mode choice.

The explainer summarizes research about how much households typically respond to fuel prices. Overall, a carbon price at the level considered in recent US policy proposals would cause modest reductions in emissions.

Transportation Sector Emissions

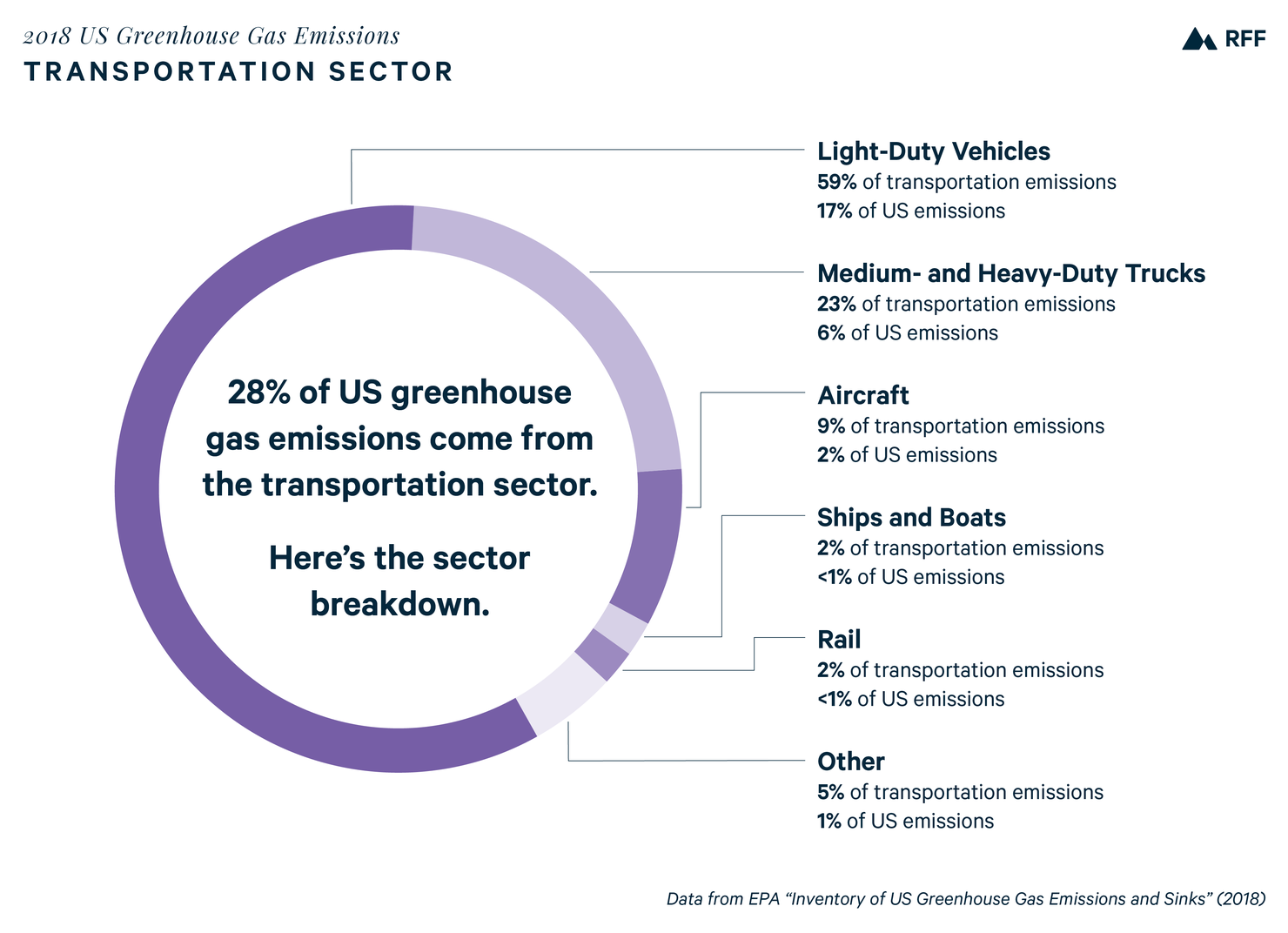

The transportation sector accounts for 28 percent of total greenhouse gas emissions in the United States. Within this sector, about 59 percent comes from light-duty passenger vehicles, 23 percent comes from medium and heavy-duty vehicles, 9 percent comes from aircraft, and the remaining 9 percent is from rail, ships and boats, and other sources.

Figure 1. 2018 Transportation Sector Emissions Breakdown

During the past 30 years, emissions from the transportation sector have grown by about 24 percent. Transportation emissions grew rapidly between 1990 and 2007, then fell due to slowed economic activity caused by the Great Recession. Between 2012 and 2018, transportation sector emissions grew by an average of 1.2 percent per year, about half the average rate of economic growth over the same period; emissions per dollar of GDP declined during this period.

There is considerable uncertainty about the future trajectory of transportation emissions. Prior to the COVID-19 pandemic, transportation sector emissions were expected to continue growing, primarily due to expected increases in vehicle travel, especially for heavy-duty vehicles. Even as the economy recovers from the pandemic, it is uncertain whether households and businesses will revert to past behavior. Anticipated innovation, such as automated driving, creates additional uncertainty about future transportation demand. Notwithstanding this uncertainty, current policies such as federal vehicle emissions standards and state zero-emission vehicle programs are likely to be insufficient for achieving a net-zero transportation sector or even deep decarbonization (80 percent or greater reductions).

Carbon Pricing Policy Options and Effects

Options for pricing carbon in the transportation sector include a carbon tax and cap and trade. A cap-and-trade program places a cap on the total amount of emissions from the transportation sector. Regulated firms must hold or surrender to the government one allowance for every ton of carbon dioxide emitted. Permits can be traded among polluters, and thus the price for carbon is determined through a market rather than administratively. A carbon tax, on the other hand, sets a price on emissions instead of a quantity of emissions and is applied based on the carbon content of the fuel (that is, accounting for the fact that some fuels such as diesel contain more carbon per gallon than other fuels). Read “Carbon Pricing 101” to learn more about these options.

Transportation fuels have a long and complex supply chain, from oil extraction to refineries, fuel distributors, and retail stations. A jurisdiction that prices carbon must choose the point of regulation—that is, where along the supply chain to impose the carbon price. Jurisdictions may want to take advantage of existing tax collection infrastructure, as the administrative cost of imposing a new tax can be high. For example, if fuel taxes are collected from fuel distributors, the jurisdiction may find it convenient to impose a carbon tax at that level. The State of California, for example, requires fuel distributors to hold allowances for the emissions from the fuels they sell.

The point of regulation and the effectiveness of a carbon price in reducing transportation emissions are ultimately determined by how much retail fuel prices change. Pass-through refers to the degree to which retail fuel prices are affected by pricing carbon further upstream: the greater the pass-through, the more the fuel prices increase for a given carbon price. There is strong, but not conclusive, evidence that fuel taxes have high pass-through. If carbon prices affect fuel prices similarly to fuel taxes, households would see the full effect of the carbon price showing up as an increase in retail fuel prices that is proportional to the carbon content of the fuel.

By raising retail fuel prices, carbon pricing in the transportation sector reduces emissions through five primary channels:

- Fuel economy choice

- Fuel type switching

- Technological innovation

- Travel mode switching

- Reductions in overall travel

The remainder of this explainer discusses each of those channels in more detail.

Fuel Economy Choice

A carbon price in the transportation sector encourages drivers to switch to more fuel efficient vehicles, which reduces emissions. Fuel economy choice refers to traveling in a vehicle that has greater fuel economy, which is defined as the number of miles traveled per unit of fuel used (for example, miles driven per gallon of gasoline). A vehicle with higher fuel economy can travel further on a single unit of fuel or the same distance on less fuel, relative to a vehicle with lower fuel economy. A carbon price incentivizes travelers to use a vehicle with greater fuel economy to reduce travel costs.

Vehicle Portfolio Choice

Many households have multiple vehicles with different fuel economy ratings. Such households may respond to a carbon price by deciding to drive their more fuel-efficient vehicle more to dampen the impact of the carbon price on their fuel spending. The average fuel economy weighted by miles traveled would increase, and the household’s gasoline consumption would fall, even without driving less.

New Vehicle Purchase Decisions

A carbon price would also affect people’s decisions when buying a new vehicle. When gasoline prices increase, vehicle buyers substitute for vehicles with better fuel economy to avoid paying more for fuel. This effect is illustrated by how gasoline price changes cause shifts in market shares for cars (which tend to have relatively high fuel economy) and light trucks (which tend to have relatively low fuel economy). Increases in gasoline prices tend to increase the market share of cars and decrease the market share of light trucks. This substitution raises the average fuel economy of new vehicles sold. High fuel prices may also cause new vehicle consumers to substitute within the car and light truck categories, such as buying a small car instead of a mid-size car, or the hybrid rather than the gasoline version of a model.

Vehicle Retirement Decisions

A carbon price, and the resulting fuel price increase, can also cause people to hold on to fuel efficient vehicles longer and scrap gas guzzlers more frequently. This raises the average fuel economy and decreases the total emissions of all vehicles on the road.

Summary

In summary, fuel economy switching occurs due to multiple household decisions. Along each margin of adjustment, a carbon price increases average fuel economy, which lowers fuel consumption for the same amount of travel.

The impact of a carbon price on fuel economy switching depends on multiple factors, including the stringency of the carbon price chosen (the tax rate or cap level) and the composition of the vehicle fleet. The higher the carbon price, the more it will influence fuel economy switching. In prior research, we found that a one dollar increase in gasoline prices, which is approximately equivalent to a $100 per ton carbon tax, would increase fuel economy of new vehicles sold by 0.24 miles per gallon. This is a modest impact, but a caveat to this result is that is based on short run household decisions. We expect the long run impact to be considerably higher.

In fact, past research has concluded that fuel economy choices respond more to fuel taxes than to other types of fuel price changes. States commonly change their fuel taxes by 5-10 cents from one year to the next, and households respond several times more strongly to these changes than to equivalent changes in fuel prices caused by other factors (such as oil price movements). The larger response may be explained by the salience of gas tax changes (i.e., the extensive news coverage that often accompanies them) or because tax changes are highly persistent. If households respond to a carbon price similarly as to a fuel tax, a carbon price of $100 per metric ton could cause fuel economy to increase by close to 1 mile per gallon--still a modest change. Average fuel economy of new vehicles is currently about 25 miles per gallon; tightening fuel economy standards caused average fuel economy to increase by about 3 miles per gallon between 2012 and 2018.

A carbon price would also likely result in fuel economy switching among medium- and heavy-duty truck owners. Research has found that truck buyers value reductions in truck fuel costs, so by increasing diesel prices, a carbon price would increase the demand for fuel-efficient trucks relative to fuel-inefficient trucks. The magnitude of this effect might be modest, however, as research has found that heavy-duty truck buyers substantially undervalue full lifetime fuel costs.

Fuel economy switching might be muted by interactions with other existing regulations, including federal fuel economy standards. A moderate carbon price would increase the demand for fuel economy, but fuel economy of new vehicles sold would not change if federal or state standards already required higher average fleet-wide fuel economy. A sufficiently stringent carbon price, however, would provide an incentive beyond existing federal standards. Furthermore, even a moderate carbon price would lower the costs of tightening federal fuel economy standards, which could justify tightening the standards. And regardless of fuel economy standards for new vehicles, a carbon price would cause scrappage of vehicles with low fuel economy, so we would still expect to see fuel cost savings for the entire fleet.

Fuel Type Switching

In addition to encouraging the use of more efficient vehicles, a carbon price in the transportation sector can similarly encourage users to switch to vehicles that use less carbon-intensive fuels. For example, a household may decide to purchase an electric vehicle instead of a gasoline vehicle. A carbon price incentivizes travelers to switch to vehicles powered by more energy-efficient fuels. Electric vehicles, for example, are much more energy efficient than gasoline vehicles.

During the last decade, we have seen a dramatic growth of plug-in hybrid and electric vehicles available in the marketplace. Consumers now have more opportunities to switch fuel types to reduce their carbon footprint and fuel costs. A carbon price encourages travelers to use vehicle fuel types that pollute and cost less per mile of travel. Electric vehicles are a prime example. These vehicles have much lower fuel costs than gasoline vehicles, even with low gasoline prices that we experience today. For example, a gas-powered 2020 Toyota Camry has a combined city/highway fuel economy of 34 miles per gallon. According to fueleconomy.gov, an average driver would pay about $950 per year in fuel costs for the Camry, but only $500 per year for standard-range Tesla Model 3. This difference represents a substantial fuel cost savings of nearly 50 percent. These savings are small relative to the typical price differences between gasoline and plug-in vehicles, though of course the comparison differs for different pairs of gas and electric vehicles. The added fuel cost resulting from a carbon price would increase this price gap and encourage consumers to consider electric vehicles, although this effect would likely be small given carbon a carbon price of say $50 per metric ton of carbon dioxide.

The extent to which fuel-switching would reduce emissions under a carbon price is a function of market characteristics:

Buyer Preference: A key characteristic is the propensity for gasoline vehicle buyers to switch to owning an electric vehicle. Electric vehicle buyers tend to have different preferences than gasoline vehicle buyers; many gas vehicle buyers may not be interested in switching.

Availability: A significant barrier to switching is that relatively few plug-in hybrid and electric vehicles are available for purchase. As of the 2019 model year, 28 different plug-in vehicles and 17 different all-electric vehicles were available in the new passenger vehicle market. This is a tiny number compared to the number of gasoline vehicle options, which ranges between 300 and 400 unique models. Gasoline vehicle buyers are accustomed to being able to select a vehicle that perfectly reflects their preferences, and many may not want to sacrifice this by limiting themselves to a relatively small selection of electric vehicles. As more electric vehicle models enter the new vehicle market, a carbon tax is likely to have a larger impact on encouraging vehicle buyers to substitute electric vehicles for gasoline models.

Regulation: Fuel type switching might also be muted by interactions between a carbon price and other existing regulations, including state zero emissions vehicle (ZEV) programs. A moderate carbon tax would increase the demand for plug-in and battery electric vehicles, but the share of ZEVs may not change much if the requirements under state ZEV programs already require increased ZEV sales. A sufficiently stringent carbon tax, however, would provide an incentive beyond existing ZEV programs. Furthermore, even a moderate carbon tax would lower the costs of ZEV program requirements because the carbon price increases consumer demand for ZEVs. If the ZEV requirements were tightened in response to a carbon tax, we would expect fuel type switching for new vehicles.

Technological Innovation

A carbon price reduces emissions by incentivizing technology adoption and innovation in the near and long terms. To stay competitive, in the near term, vehicle manufacturers add existing technologies to their vehicles, such as variable valve timing, or by introducing a completely new model, such as the Toyota Prius in early 2000. Companies make these decisions in response to changes in market conditions, such as swings in gasoline prices, as well as to policy, such as tightening fuel economy standards for new vehicles. In the longer term, manufacturers can innovate and develop new technologies, such as recently developed versions of Atkinson-cycle engines in many Mazda vehicles. Often, new technologies are adopted in high-end vehicles, before diffusing more broadly across the market.

By raising the price of gasoline, a carbon tax would increase the demand for more fuel-efficient vehicles and vehicles powered by alternative fuel types. This would spur innovation along several different vehicle characteristics, encouraging automakers to introduce technologies to improve vehicle qualities including fuel economy and fuel type. Some companies would respond to the tax by making the gasoline engines of their current vehicle fleet more fuel efficient. This would increase the fleet average fuel economy of new vehicles sold, which would eventually increase the overall fuel economy of the entire stock of cars and trucks on the road. Other companies would respond to the tax by introducing new vehicle models with better fuel economy or with a new power type, such as a plug-in hybrid or a battery electric vehicle.

Like fuel economy and fuel type switching, it is important to note that this innovation might be muted by interactions with other existing regulations, including federal fuel economy and greenhouse gas standards and state ZEV programs. A moderate carbon tax may not provide any additional incentive for manufacturers to innovate because fuel economy and greenhouse gas standards for the vehicles already encourage these innovations. A sufficiently stringent carbon tax, however, would provide an incentive beyond existing federal and state standards. Furthermore, even a moderate carbon tax would lower the costs of tightening all three types of standards. If the standards were tightened in response to a carbon tax, we would expect innovation to occur.

Reductions in Overall Travel

Carbon pricing raises wholesale fuel prices, which leads to higher retail fuel prices. In the short and medium term, consumers can respond to higher retail prices by reducing fuel consumption through energy conservation efforts, such as carpooling or working remotely. Notably, the extent to which these changes occur depends on the consumer and the price elasticity of demand for travel (the amount that demand changes as a result of a change in price). Short-run price elasticity of demand estimates for travel are typically quite small. One study found that medium-run price elasticity for driving is inelastic (price changes do not greatly affect demand), suggesting that fuel conservation responses are likely small.

The long-term fuel price elasticity may be larger, because consumers make different investments to adapt to higher fuel prices. Over the long term, if a carbon price is introduced with some long-term certainty, then individuals may decide to take trips that require fewer miles traveled and fewer trips. A carbon price could also encourage long-run changes in where people live, which can dramatically alter trip demand. It can also cause individuals to reallocate their spending budgets toward non-trip related activities, which reduces total miles traveled.

Conclusion

We have seen that a carbon price reduces carbon dioxide emissions from the transportation sector by raising fuel prices; by encouraging households to own and drive vehicles with higher fuel economy; and by encouraging people to drive their vehicles fewer miles. However, research on household responses to fuel taxes and fuel prices suggests that these effects are modest. For example, a price of $100 per metric ton of carbon dioxide would probably not raise average fuel economy of new vehicles by more than 1 mile per gallon. While this response would reduce emissions, the effect would be smaller than that of recent changes in federal fuel economy standards, and it would be insufficient to decarbonize the transportation sector. However, a carbon price would reduce emissions more cost effectively than fuel economy standards.